Donor development is a daily exercise in balance, particularly when it comes to solicitation frequency. How often should you ask? Are you asking too often? Or not often enough? Fortunately, your donors answer these questions by how they respond to your communications and solicitations. Here are five ways to tell if you’re not soliciting your donors as often as you should, and some suggestions for how you can optimize your solicitation calendars based on what your donors are telling you.

Donor development is a daily exercise in balance, particularly when it comes to solicitation frequency. How often should you ask? Are you asking too often? Or not often enough? Fortunately, your donors answer these questions by how they respond to your communications and solicitations. Here are five ways to tell if you’re not soliciting your donors as often as you should, and some suggestions for how you can optimize your solicitation calendars based on what your donors are telling you.

1. Your newsletter raises a lot of money. Your organization’s newsletter is a tool for donor cultivation, not solicitation. So if your donors give enthusiastically to your newsletter, where you don’t directly ask, imagine how they might respond when you do ask. As a rule of thumb, if your newsletter raises more than 25% of what you raise through a typical appeal, that’s probably a sign that you’re not asking often enough, and you should consider adding an appeal to your solicitation schedule.

2. Your mailing list is 10+ times the size of your actual donor file. It’s important for organizations to create and value varied ways for individuals to be involved in their missions, whether by making a financial contribution, staying apprised of the issues by reading the organization’s communications, or by taking an action like signing a petition. But when an organization has a really big mailing list (i.e. non-donor addresses) relative to its donor list, in all likelihood it’s not offering its non-donor constituents enough opportunities to participate by making a financial contribution. After all, the individuals who read your organization’s newsletter and/or take action on behalf of your organization are already invested in your work and should be more willing than the average citizen to make a small financial investment. For good tips on converting online activists to donors, be sure to check out this post from Frogloop.

3. Your average gift is very high. Organizations that solicit their donors once or twice a year almost always have donor files with a high average gift. But the higher average gift, while nice, is also associated with a smaller donor file. Not only does a smaller donor file translate to less revenue for your organization, but it also means a smaller major and planned gift donor prospect pool. If your average gift seems high relative to other organizations like yours, this too is a sign that you are probably under asking. When you increase the number of solicitations, your average gift will decline but your overall revenue and number of donors will increase.

4. Your attrition rates are high. Donors stop giving to organizations for many reasons. Message, offer and medium, for example, all play a role in how long a donor stays with an organization but they can be very difficult to measure. There’s one highly quantifiable reason however that donors stop giving: they’re not asked often enough. If your organization’s attrition rates seem higher than that of your peers, don’t just look at how you’re asking; take a hard look at how often you’re asking. You can find some good ideas on curbing donor attrition by the way right here on Guidestar.

5. Your final membership renewal notice nets revenue. The vast majority of organizations acquire new donors at a net loss, which is recovered over time through subsequent cultivation and solicitation. So when soliciting a donor’s renewed support, organizations should weigh the per donor cost in renewal/reinstatement against the per donor cost in acquisition. If your organization’s final membership renewal notice nets revenue, or even just breaks even, you should consider adding at least one more renewal effort. Not only will your additional renewal effort probably yield renewed donors at a lower cost than a new donor acquisition would, but it may also result in more revenue over the long term, as reinstated donors are known to have higher lifetime value than first-time donors.

Have you observed any other signs of under asking in your organization? As always, we want to hear from you, so  post your experiences here.

post your experiences here.

On another note, we’ll be releasing our 2010 Idea Book in just a couple of weeks!

To request your free copy in advance, email us at ideabook@mkdmc.com with your name and address, and anything else you’d like to share.

There are many important online resources for membership development, but probably only just a few that we feel we couldn’t do without. Today, I’m highlighting some of the essential blogs, Twitter feeds, and resources that I look to for top-notch information, insight and inspiration on donor action and philanthropy:

There are many important online resources for membership development, but probably only just a few that we feel we couldn’t do without. Today, I’m highlighting some of the essential blogs, Twitter feeds, and resources that I look to for top-notch information, insight and inspiration on donor action and philanthropy:

Last week I received a great question from a nonprofit that had recently set up a

Last week I received a great question from a nonprofit that had recently set up a

“Integration” has been a buzz word in membership development for over a decade, and if last week’s

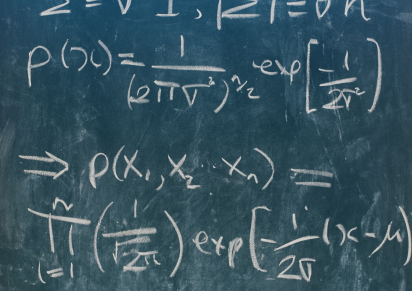

“Integration” has been a buzz word in membership development for over a decade, and if last week’s  Statisticians are equipped with a broad range of detailed tests and tightly controlled procedures to determine the probability of an outcome.

Statisticians are equipped with a broad range of detailed tests and tightly controlled procedures to determine the probability of an outcome.